As you know, my role in the hedge fund community these days is tangential at best. But I remain in touch with HF colleagues in London, New York, and San Francisco. And I continue to follow very carefully a handful of HF managers whose thinking I respect and whose results over the years have been more than impressive. Chief among these is Crispin Odey of Odey Asset Management in London. His recent remarks on the stock market (below) contradict the common sentiment of the crowd. Which is why I listen to him. Read for yourself:

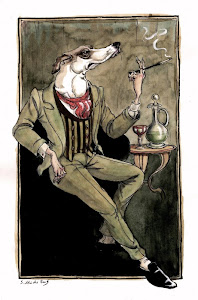

As you know, my role in the hedge fund community these days is tangential at best. But I remain in touch with HF colleagues in London, New York, and San Francisco. And I continue to follow very carefully a handful of HF managers whose thinking I respect and whose results over the years have been more than impressive. Chief among these is Crispin Odey of Odey Asset Management in London. His recent remarks on the stock market (below) contradict the common sentiment of the crowd. Which is why I listen to him. Read for yourself:'Odey is probably one of the few people in the modern financial world who believes that a "history degree is far more useful than a CFA" and a rarity among fund managers in being as comfortable talking on macro issues and politics as he is about individual stocks. His clients are the end beneficiaries of this intellectual restlessness. His long term track record stacks up against the very best. After a poor 2011 in which his funds were overweight equities too soon, 2012 is so far proving yet another stellar year.

...

Overall, Odey remains bullish on equities and has progressively cut his cash holdings. "But in Europe credit is broken so it is hard to say any trend or rally will be maintained in the long run. The only thing I am absolutely certain of is that cash and bonds will not earn a real return and that equities are cheap. They are cheap because they are unloved and will continue to be volatile, but equities remain the right asset class to hold to protect wealth," he says.'

Scott’s: with Crispin Odey, Founder, Odey Asset Management, EuroWeek, 20 April 2012

4 comments:

It was one year into my Economics course that I walked into this history class taught by an elderly Italian Economic historian...I switched immediately to History.

The private equity and venture capital fund structure are identical to the "contratto di commenda" which the maritime republics like Venice, Genoa, Amalfi used to fund merchant voyages. 2% management fee, 20% carried interest...circa 1000 AD. They were likely copied from the ancient Romans.

If we still don't understand their engineering, can you imagine the sophistication of their financial intruments?

"history degree is far more useful than a CFA"

Great quote.

Cody, how do you rate the British historian Niall Ferguson?

Well I don't know anything about finance but Niall F is a professional contrarian but I do enjoy his work.

Odey does seem like a sharp guy & I like it he's not just another quant. As for Niall Ferguson, I rate him very highly after reading his last two books (The Ascent of Money & Civilization) and took great delight at his slighting that preposterous book by Jared Diamond-Guns, Germs, & Steel.

Post a Comment